News Center

R&D internal volume and admission rate is only 25%! How to reconstruct the pattern of innovative drugs under the New Deal?

- Categories:Media reports

- Author:

- Origin:New Kang Territory

- Time of issue:2021-08-20

Medical News, August 20: On July 2, the Center for Drug Evaluation (CDE) of the State Food and Drug Administration issued the "Clinical Value-Oriented Guiding Principles for Clinical Research and Development of Anti-tumor Drugs" for soliciting comments (hereinafter referred to as the "Guiding Principles"). One stone caused a thousand waves of waves, and the capital market responded strongly, and the pharmaceutical stock index fell for many days. "Moutai in Medicine" Hengrui Medicine has fallen from the throne of the pharmaceutical stock market value, ranking behind the leading medical device Mindray Medical and the leading pharmaceutical outsourcing service WuXi AppTec. This policy is tantamount to bringing an "ice bucket challenge" to the burgeoning Chinese innovative medicine industry.

The core of the guiding principle is to require new drugs under development to have better clinical value than drugs already on the market, including improving clinical efficacy, reducing adverse reactions, and improving ease of use. The new policy temporarily focuses on the oncology field where the research and development of innovative drugs is most concentrated, but in the future it is very likely to expand to the fields of anti-infection, metabolism, immunity, cardiovascular and cerebrovascular diseases, and the central nervous system. The guiding principles provide reasonable guidance for the research and development of anti-tumor drugs by strictly standardizing the design of clinical trials. Higher and stricter requirements have raised the threshold for innovative drug research and development, which is bound to have a significant impact on innovative drug research and development companies and closely related medical research and development outsourcing service companies (CRO/CDMO).

Current status of China's innovative drug R&D

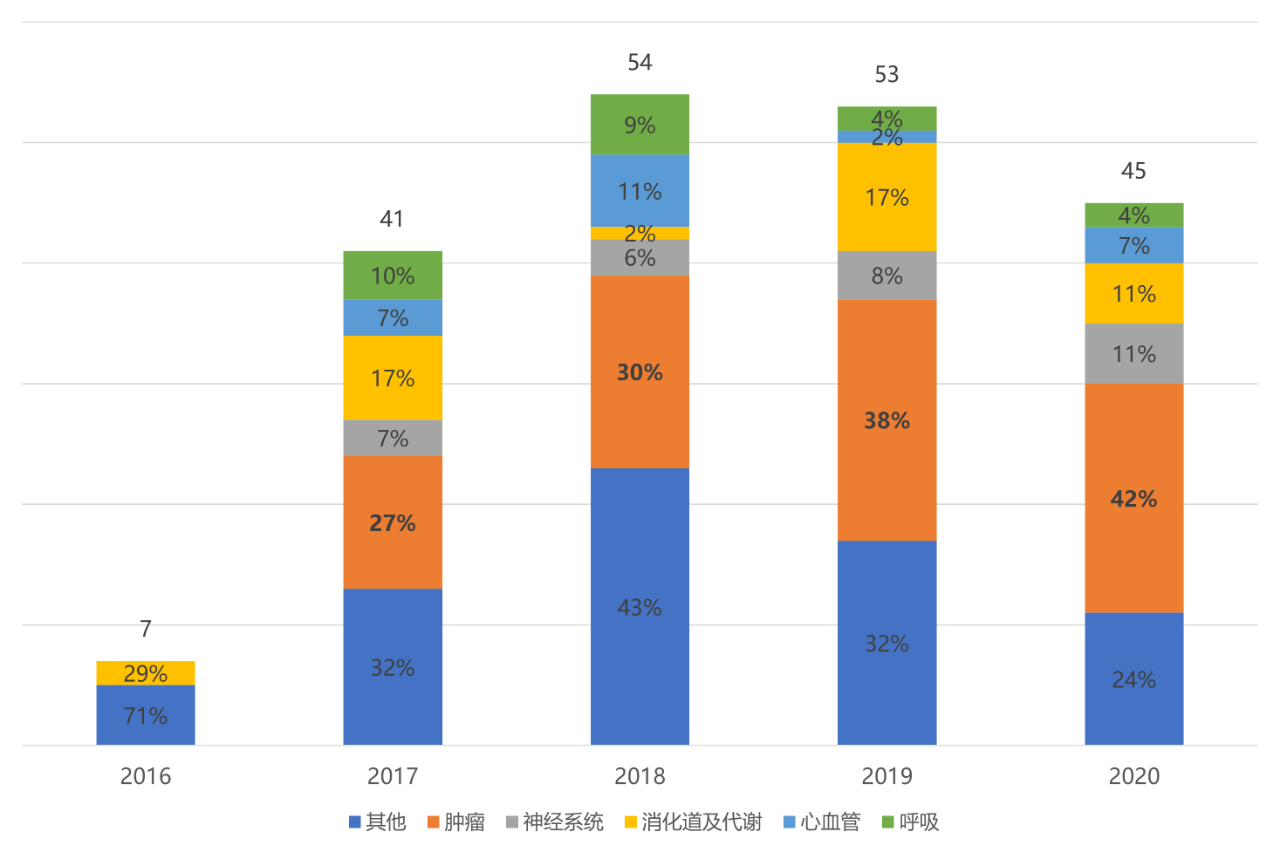

In order to see the impact of the guiding principles more clearly, it is necessary to analyze the current status of China's innovative drug research and development. 2016-2020 is a five-year period of China's pharmaceutical innovation. The reform of the drug review and approval system has continued to deepen, overseas senior talents have returned to China to start businesses, and the 18A policy of the Hong Kong Stock Exchange and the Science and Technology Innovation Board have followed one after another. The interaction of policies, capabilities, capital, and a virtuous circle have enabled China's pharmaceutical innovation to enter the fast lane of development. In the past five years, China has listed 200 innovative drugs, 33% of which are anti-tumor drugs. Among them, multinational pharmaceutical companies contributed 156 innovative drugs, accounting for 78%.

Figure 1. The distribution of innovative drugs on the market in China from 2016 to 2020 by disease field

Source: Public information, Zhongkang Industrial Capital Research Center

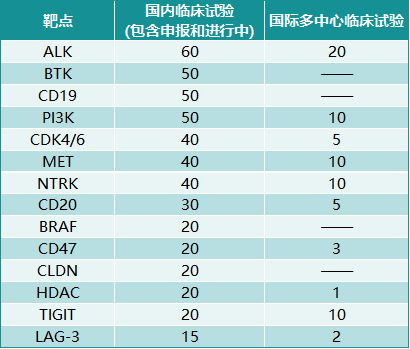

According to official statistics, CDE will accept 9,768 applications in 2020, of which 60% are anti-tumor drugs. The 777 anti-tumor drug clinical trial applications approved in 2020 covered 150 targets, of which 133, 68, and 46 were carried out for PD-1/PD-L1, VEGF, EGFR, FGFR and HER-2 targets, respectively , 34 and 33 clinical trials. Clinical trials targeting the above 5 targets accounted for more than 40% of clinical trials targeting 150 targets. In addition to the above-mentioned targets, innovative drug R&D companies are eager for other newer targets and newer drug technology types, adopting a "fast-follow" strategy to quickly set foot on the new track.

Chart 2. The number of domestic clinical trials on some anti-tumor drug targets

Source: FIC database, Zhongkang Industrial Capital Research Center

New policies lead the new direction of China's innovative drug research and development

China’s new drug R&D has over-focused on popular targets, and the ubiquitous “high level of duplication” has led to a low level of innovation differentiation. With the increasing number of me-too drug research and development projects with the same target and the same indications, on the one hand, it runs on clinical trial resources, resulting in a slowdown in research and development; on the other hand, it is impossible to effectively select the most clinically advantageous drug Drugs cause loss of life and property. In this dilemma, in order to optimize the allocation of new drug research and development resources, guiding principles have emerged.

Current registered clinical trials require the use of standard therapy (SoC) in the authoritative diagnosis and treatment guidelines as the positive control, but the guidelines usually have a revision cycle of one to several years. The guiding principle requires that the comparison be set as the current best treatment option. This real-time update mode breaks the shackles of the diagnosis and treatment guidelines and speeds up the iterative speed of drugs. Under the new policy, the later-marketed drugs must have better clinical value than the first-marketed drugs, which sets a dynamic threshold for the development of new drugs.

In order to cope with the impact of the guiding principles, companies need to optimize their R&D pipelines, voluntarily abandon me-too drug projects with relatively lagging R&D progress and relatively insufficient R&D resources, and make every effort to promote superior projects, and pass priority reviews, breakthrough therapies, Orphan drug qualification certification and other magnified advantages. On the one hand, it promotes the rational allocation of R&D resources, and on the other hand brings better new drugs to patients faster. The fierce "involution" among me-too drugs will encourage companies to develop first-in-class (FIC) drugs with less competition and better market prospects. In terms of pipeline construction, companies will change from blindly pursuing "you have me and I have" to "all me faster" and "you don't have me."

Under the new policy, the latecomers have to face the difficulties, and the first movers have to be prepared for danger in times of peace. Once the latecomers are approved for marketing with better clinical value, whether they are me-too drugs or FIC drugs, their market position will inevitably be in jeopardy, so companies must actively optimize their original products or ( And) Develop new products. This "catfish effect" will bring vitality and impetus to the entire innovative medicine industry.

In general, the guiding principles will bring a positive leading role in the direction of China's innovative drug research and development. However, it should be noted that it is currently only a draft for comments, and there are still arguable points, including: (1) better clinical practice How to determine the value, how to choose between effectiveness, safety, and compliance; (2) If the development of two me-too drugs is basically synchronized, whether it is necessary to conduct a head-to-head test between the two to judge the clinical value. It is believed that the above problems will be resolved in the officially released guidelines.

Difficulties in the commercialization of innovative drugs

Although the fast-follow-based R&D strategy has been criticized at the moment, objectively, this was once the only way for China's innovative drug industry to grow out of nothing and cross the river by touching the stones, step by step. In recent years, China's innovative drug industry has achieved zero breakthroughs in many fields and achieved fruitful results. After the successful research and development of innovative drugs, successful commercialization is even more important. On the one hand, it realizes therapeutic value and benefits patients; on the other hand, it realizes commercial value and promotes the sustainable development of enterprises. However, because the availability of innovative drugs is affected by various policies, many patients have not been able to benefit in time.

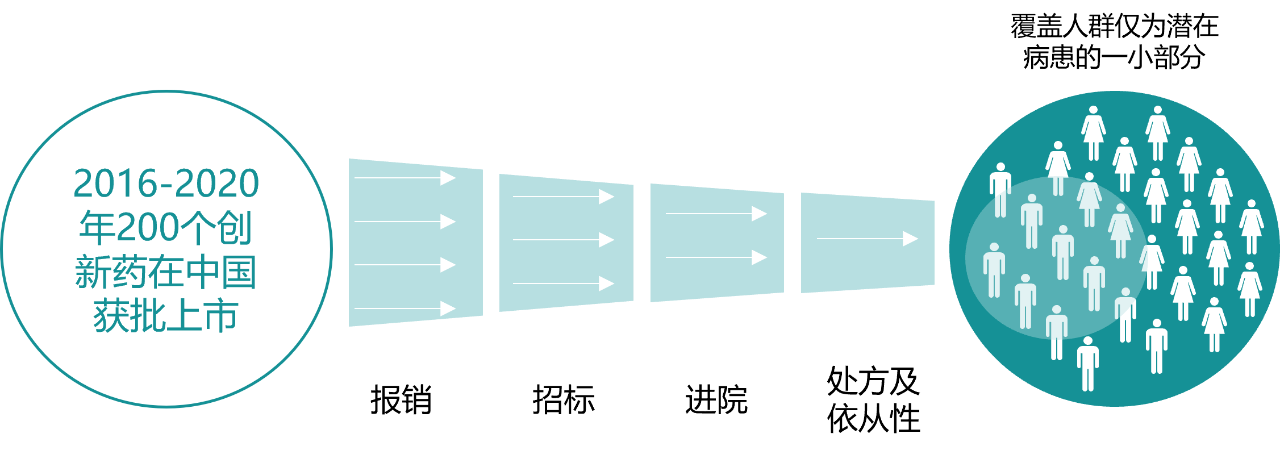

Figure 3. The availability of innovative drugs in China is affected by multiple links

Source: Public information, Zhongkang Industrial Capital Research Center

At present, the regularized annual national medical insurance negotiations are the most important market access channel for innovative drugs. The price reduction of innovative drugs is included in the national medical insurance drug catalogue in a timely manner through price-for-volume exchange, in order to increase affordability and accessibility. However, the assessment indicators that once or still exist, such as the proportion of medicines, total control, average cost per time, and the number of product regulations, have caused hospitals to worry about taking medicines. Innovative drugs are not only more expensive, but also have higher requirements for storage and use. After the implementation of zero drug addition, the clinical application of innovative drugs has brought cost pressures to hospitals, which has seriously affected the enthusiasm of hospitals to purchase drugs.

The drug access model of medical institutions that has not been significantly changed, no longer matches the greatly accelerated medical insurance access, which leads to the formation of a barrier for negotiated drugs in front of the gate of admission. According to the statistics of the 1420 sample hospitals of the Chinese Pharmaceutical Association, less than 20% of the oncology innovative drugs negotiated for inclusion in the National Medical Insurance List in 2018 have been admitted to the hospital by the end of 2019. As of the third quarter of 2020, only about 25% of the varieties included in 2019 have been admitted to the hospital. The "last mile" of market access for innovative drugs has encountered difficulties in hospital admissions. At the national "two sessions" in March 2021, "difficulty in hospital admission of innovative drugs" became the focus of attention of representatives from the medical and health circles.

"Dual Channel" Policy Improves Access to Innovative Medicines

On May 10, 2021, the National Medical Insurance Administration and the National Health Commission jointly announced the "Guiding Opinions on Establishing and Improving the "Dual Channel" Management Mechanism for Drugs in National Medical Insurance Negotiations" (hereinafter referred to as the "Guiding Opinions"), which will be the first designated medical institution + The "dual channel" model of designated retail pharmacies is promoted at the national level to improve the availability of negotiated drugs. According to the data of the pilot pilot in Sichuan Province, the supply ratio of medicines using the dual-channel model in hospitals and out-of-hospital pharmacies (DTP pharmacies) is about 20% and 80%, respectively.

The dual-channel implementation involves five subjects, including medical insurance departments, medical institutions, designated pharmacies, circulation companies, and patients. In order to ensure the smooth implementation of the dual channel, the guidance has given more powers to the provincial medical insurance administrative departments. The medical insurance department can screen the dual-channel negotiated drugs based on the local economic development level, fund affordability, and patient demand for medication, and urge designated medical institutions and retail pharmacies to standardize their equipment in a timely manner. For negotiated drugs that have a long use period and high treatment costs, under the premise of ensuring the safety of the fund, a separate payment policy can be implemented, and it will not be included in the total medical insurance control scope of designated medical institutions. The medical insurance department can dynamically adjust the scope of dual-channel and separately paid drugs according to changes in the situation. The medical insurance department is also responsible for establishing and improving the selection and exit mechanism of dual-channel designated retail pharmacies.

Under the dual-channel policy, innovative drugs must not only consider reasonable price reductions to enter the national medical insurance catalog, but also actively cooperate with provincial medical insurance administrative departments in light of the specific market conditions of each province to strive to enter the dual-channel or separate payment and drug scope. This has further intensified the competition among similar me-too drugs, and only drugs with better clinical value and more reasonable prices can win the competition. The dual-channel policy makes negotiated drugs no longer crowded in the single-channel hospital terminal, which is conducive to rapid sales. It is even more favorable for biotech companies with insufficient academic promotion capabilities in hospitals.

Conclusion

In 2021, the two new policies issued by the three major medical and health regulatory authorities: the National Medical Insurance Administration, the National Health Commission, and the National Food and Drug Administration have led the new direction of China's innovative drug R&D and commercialization, which embodied in another form The three-medicine linkage of the new medical reform. The "Clinical Value-Oriented Anti-tumor Drug Clinical Research and Development Guidelines" will lead China's innovative drugs to shift from demanding quantity to demanding quality after the formal implementation, and will have a profound impact on the research and development pattern of the entire industry. The "Guiding Opinions on Establishing and Improving the "Dual Channel" Management Mechanism for National Medical Insurance Negotiation Drugs" makes the market access process of China's innovative drugs faster and smoother, and accelerates the development of pharmaceutical companies while benefiting patients.

RELATED NEWS

Business Email:hbmlyy@merriclin.cn HR Email:hr@merriclin.cn

Company address:No. 8 Heping Road, Economic Development Zone, Yunmeng County, Xiaogan, Hubei Postal code:432500 This website supports IPV6

Copyright © 2012-2021 Hubei Merriclin Pharmaceutical Co.,Ltd. Powered by www.300.cn

Filing information:鄂公网安备42092300000000号 鄂ICP备20010943号-1 《Internet information service qualification certificate》No.(E) - non operating-2020-0023

Operation information: the website has been running for 00001 days. It is recommended to use the browser based on chromium core to browse the website at a resolution of no less than 1920 * 1280px to obtain good browsing effect.

Merriclin Official Website

Merriclin WeChat Official

Home

Home About Us

About Us News

News Products

Products R & D Center

R & D Center HR

HR Help Center

Help Center Contact Us

Contact Us